Research

List of publications and working papers

Working papers

- Can a formalization program create dynamic entrepreneurs? Evidence from Brazil2026

We study the impact of Brazil’s introduction of a new legal status – the Microempreendedor Individual (MEI), which simplifies registration and compliance – on the creation of dynamic firms. We assemble a matched administrative dataset linking the firm registry (CNPJ) to the universe of formal employment records (RAIS), allowing us to identify founders and track firm outcomes. Leveraging industry-level MEI eligibility in a difference-in-differences design, we estimate causal effects on entry and growth. MEI increases the number of new formal entrepreneurs by 148% but initially reduces limited liability entry, consistent with substitution toward the lower-cost regime. The program also yields a net positive effect on job creation: the number of entrepreneurs who ever become employers rises by 26%, driven by newly created employer MEIs that more than offset fewer employer limited liability entrants. These findings suggest that simplified formalization can broaden the base of dynamic, job-generating firms.

@article{finamor2026formalization, title = {Can a formalization program create dynamic entrepreneurs? Evidence from Brazil}, author = {Finamor, Lucas and Garriga, Pablo and and Morales Lema, Raul and Vilarouca Nunes, Rafael}, year = {2026}, working_paper = {https://pablogarriga.github.io/files/entrepreneurs-bra.pdf}, group = {Working papers}, } - Payments Under the Table in Latin AmericaJavier Feinmann, Ana Paula Franco, Pablo Garriga, Nathalie Gonzalez-Prieto, Roberto Hsu Rocha, and Maximiliano Lauletta2026

This paper investigates a neglected aspect of informality in Latin America—Payments Under the Table (PUT), where registered firms make off-the-books salary payments to registered employees. We conduct the first multi-country large-scale survey on this topic, covering Brazil, Argentina, Mexico, Colombia, Chile, and Peru, being representative of over two-thirds of Latin America’s population. Out of the more than 5,000 formal workers surveyed, our results indicate that 16% of them receive some part of their compensation under the table. Among PUT receivers, on average 24% of their labor earnings are paid off the books.

@article{feinmann2026payments, title = {Payments Under the Table in Latin America}, author = {Feinmann, Javier and Franco, Ana Paula and Garriga, Pablo and Gonzalez-Prieto, Nathalie and Hsu Rocha, Roberto and Lauletta, Maximiliano}, year = {2026}, group = {Working papers}, } - The Elasticity of Taxable Income Across CountriesClaudio A. Agostini, Zareh Asatryan, Laurent Bach, Govindadeva Bernier, Marinho Bertanha, Katarzyna Bilicka, Anne Brockmeyer, Jaroslav Bukovina, Guillermo Falcone, Pablo Garriga, Yuxuan He, Petr Jansky, Evangelos Koumanakos, Tomas Lichard, Tomas Martins, Elena Patel, Joao Santos, Louis Perrault, Jan Palguta, Nathan Seegert, Oliver Skultety, Kristina Strohmaier, Maximilian Todtenhaupt, Guillermo Vuletin, and Branislav ZudelOct 2025

We produce the largest cross-country dataset of corporate elasticity of taxable income estimates to analyze why these elasticities differ across countries. We develop a harmonized method and apply it to administrative firm-level tax data from 19 countries. Exploiting bunching at zero taxable income, we estimate firm-level elasticities. Elasticities range from 0.075 in Ecuador to 1.91 in Canada, with an average of 0.6. To explain this variation, we pair our estimates with 95 country-level characteristics. A random forest model and Shapley decomposition show that tax policy, country fundamentals, and firm characteristics each explain about one-third of the cross-country variation in ETIs.

@article{agostini2025elasticity, title = {The Elasticity of Taxable Income Across Countries}, author = {Agostini, Claudio A. and Asatryan, Zareh and Bach, Laurent and Bernier, Govindadeva and Bertanha, Marinho and Bilicka, Katarzyna and Brockmeyer, Anne and Bukovina, Jaroslav and Falcone, Guillermo and Garriga, Pablo and He, Yuxuan and Jansky, Petr and Koumanakos, Evangelos and Lichard, Tomas and Martins, Tomas and Patel, Elena and Pereira dos Santos, Joao and Perrault, Louis and Palguta, Jan and Seegert, Nathan and Skultety, Oliver and Strohmaier, Kristina and Todtenhaupt, Maximilian and Vuletin, Guillermo and Zudel, Branislav}, year = {2025}, month = oct, working_paper = {https://pablogarriga.github.io/files/eti.pdf}, group = {Working papers}, } - Corporate Responses to Size-Based Tax Rates in LithuaniaPablo Garriga and Thiago ScotWorld Bank Policy Research Working Paper, 2023

https://www.worldbank.org/en/region/eca/brief/ecace-academy

The existence of preferential tax rates based on firm size is usually justified on the grounds of providing support for entrepreneurs and small and medium enterprises (SMEs). However, they may also provide the wrong incentives for some firms that may try to remain small in order to take advantage of the special treatment. On the one hand, there exists broad evidence in the economics literature that sizedependent policies (not only tax policy) can affect the growth of firms: providing strong benefits for small firms might discourage them from becoming larger (Bachas, Fattal Jaef, and Jensen 2019; Asatryan and Peichl 2017). On the other hand, it is an empirical question whether any specific size-dependent policy is enough of a deterrent for firms’ growth. In this paper we study how firms in Lithuania respond to a notch in the corporate income tax (CIT) schedule. The main feature of the CIT in this setting is that firms face two possible tax rates on their profit: a standard 15% rate and a reduced 5% rate for companies with fewer than ten employees and declaring turnover below € 300,000. This sudden increase in average tax rates when firms declare slightly higher turnover generates strong incentives to reduce declared turnover. We document the existence of a static response—firms respond to differential tax rates in the short run in order to stay below the threshold—and provide suggestive evidence of a dynamic response—firms bunching in one period are more likely to report lower revenue growth in subsequent periods.

@article{garriga2023corporate, title = {Corporate Responses to Size-Based Tax Rates in Lithuania}, author = {Garriga, Pablo and Scot, Thiago}, journal = {World Bank Policy Research Working Paper}, number = {WPS 10500}, year = {2023}, working_paper = {https://documents.worldbank.org/en/publication/documents-reports/documentdetail/099313106262317603/idu0e3c1b6c300a6c045390bb860c3c2931a384f}, group = {Working papers}, } - Robots, Exports and Top Income Inequality: Evidence for the U.S.Andrés César, Guillermo Falcone, and Pablo GarrigaCEDLAS Working Paper, Dec 2022

The last decades have witnessed a revolution in manufacturing production characterized by increasing technology adoption and a strong expansion of international trade. Simultaneously, the income distribution has exhibited both polarization and concentration among the richest. Combining datasets from the U.S. Census Bureau, the U.S. Internal Revenue Service, the International Federation of Robotics, EU KLEMS, and COMTRADE, we study the causal effect of industrial automation on income inequality in the U.S. during 2010–2015. We exploit spatial and time variations in exposure to robots arising from past differences in industry specialization across U.S. metropolitan areas and the evolution of robot adoption across industries. We document a robust positive impact of robotics on income for only the top 1 percent of taxpayers, which is largest for top income fractiles. Therefore, industrial automation fuels income inequality and, particularly, top income inequality. According to our estimates, one more robot per thousand workers results in relative increments of the total taxable income accruing to fractiles P99 to P99.9, P99.9 to P99.99 and P99.99 to P100, of 2.1 percent, 3.5 percent and 5.9 percent, respectively. We also find that robotization leads to increased exports to high-income and upper-middle-income economies, and that this is one of the key mechanisms behind the surge in top income inequality.

@article{cesar2022robots, title = {Robots, Exports and Top Income Inequality: Evidence for the U.S.}, author = {César, Andrés and Falcone, Guillermo and Garriga, Pablo}, journal = {CEDLAS Working Paper}, number = {0307}, year = {2022}, month = dec, working_paper = {https://www.cedlas.econo.unlp.edu.ar/wp/en/no-307/}, group = {Working papers}, } - Tax Filings vs Tax Withholdings: Behavioral Responses from Firms and Tax PreparersPablo Garriga and Darío Tortarolo2022

We use rich administrative data on turnover tax filings from Argentina and focus on the features of the withholding regime set up to collect the tax. We document sharp bunching exactly at the point where the withheld amount remitted by third-parties is equal to the tax liability declared by the firm and argue that this pattern is due to under-reporting of tax declarations incentivized by the withholding regime. By linking firms to tax accountants through shared contact information we are able to study whether they might be responsible for this behavior. First, we analyze how correlated are the behaviors of firms who share the same accountant. We are able to establish that there is a positive correlation between accountants and the bunching behavior observed on their clients. Second, we test whether there is a causal effect of accountants on firms by exploiting information on audits. We find that non-audited firms respond to their peer’s audit, suggesting that accountants act as diffusers of information across clients.

@article{garriga2022tax, title = {Tax Filings vs Tax Withholdings: Behavioral Responses from Firms and Tax Preparers}, author = {Garriga, Pablo and Tortarolo, Darío}, year = {2022}, working_paper = {https://pablogarriga.github.io/files/tax-preparers.pdf}, group = {Working papers}, }

Publications

-

The Impact of COVID-19 on Formal Firms: Micro Tax Data Simulations across CountriesJournal of Development Economics, Jun 2025

The Impact of COVID-19 on Formal Firms: Micro Tax Data Simulations across CountriesJournal of Development Economics, Jun 2025Most low-income countries lack high-frequency firm-level data to monitor the effect of economic shocks in real time. We examine whether administrative tax data can help fill this gap, in the context of the COVID-19 pandemic. In spring 2020, we used the full population of corporate tax returns for 2019 in six developing countries to predict the effect of COVID-induced shocks on formal firms’ activity. Comparing the predictions to the realized 2020 data, we find that firms were more resilient than predicted: the share of unprofitable firms increased by only 7 percentage points, while aggregate profits and taxes paid remained stable. The simulations failed to anticipate that labor and capital inputs would flexibly adjust and that large firms would be very resilient. Complementing our simulations with higher-frequency VAT data would have markedly improved predictions.

@article{bachas2025impact, title = {The Impact of COVID-19 on Formal Firms: Micro Tax Data Simulations across Countries}, author = {Bachas, Pierre and Brockmeyer, Anne and Garriga, Pablo and Semelet, Camille}, journal = {Journal of Development Economics}, volume = {175}, pages = {103461}, year = {2025}, month = jun, publisher = {Elsevier}, doi = {10.1016/j.jdeveco.2025.103461}, working_paper = {https://pablogarriga.github.io/files/covid19-firm-impacts.pdf}, group = {Publications}, } -

Firms as Tax CollectorsPablo Garriga and Dario TortaroloJournal of Public Economics, May 2024

Firms as Tax CollectorsPablo Garriga and Dario TortaroloJournal of Public Economics, May 2024https://www.iipf.org/itaxaward.html

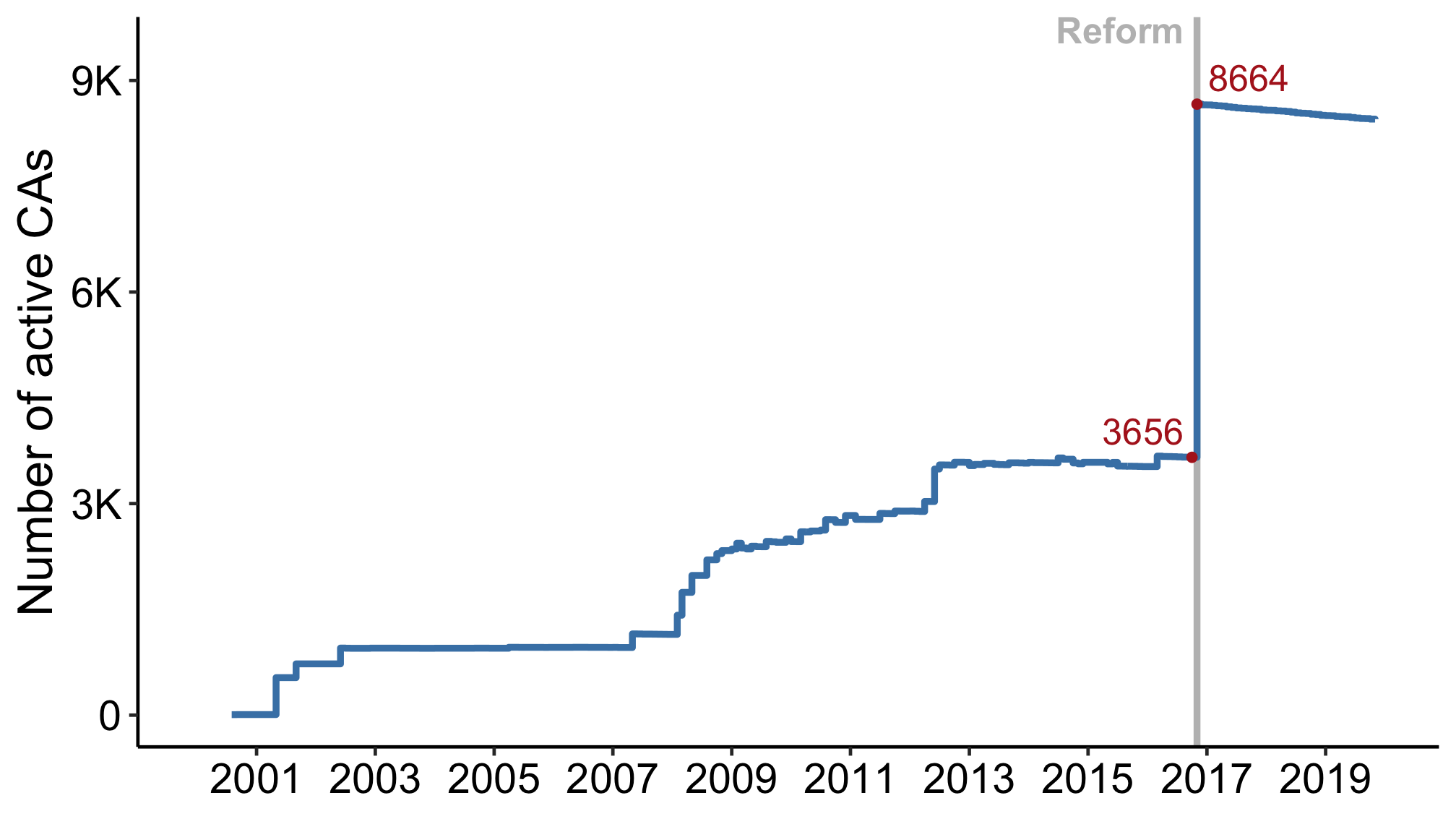

We show that delegating tax collection duties to large firms can bolster tax capacity in weak-enforcement settings. We exploit two reforms in Argentina that dramatically expanded and subsequently reduced turnover tax withholding by firms. Combining firm-to-firm data with regression discontinuity and difference-in-differences methods centered on revenue eligibility thresholds, we find that: (i) appointing large firms as collection agents (CAs) does not hinder their economic activity, (ii) it leads to a significant increase in self-reported sales and tax payments among CAs’ business partners, (iii) these effects are primarily concentrated among downstream firms that lack a traceable paper trail, and (iv) reductions in withholding lead to a decrease in self-reported sales, albeit to a lesser extent. Tax-collecting firms can thus help boost tax compliance and revenue.

@article{garriga2024firms, title = {Firms as Tax Collectors}, author = {Garriga, Pablo and Tortarolo, Dario}, journal = {Journal of Public Economics}, volume = {233}, pages = {105092}, year = {2024}, month = may, publisher = {Elsevier}, doi = {10.1016/j.jpubeco.2024.105092}, working_paper = {https://ifs.org.uk/publications/firms-tax-collectors}, group = {Publications}, } - Exports of Argentina and Brazil under the Generalized System of PreferencesFacundo Albornoz, Irene Brambilla, and Pablo GarrigaEnsayos Económicos, 2016

In this paper we investigate the impact of the Generalized System of Preferences implemented by the United States on exports of Argentina and Brazil. Our evidence indicates that the GSP increased exports from these countries to the United States, both in export quantities (intensive margin) and the fact that a product is exported or not (extensive margin). The effect, however, is more important the more advantageous is the benefit from the initial level of tariffs. We also show that the cancellation of the GSP involves falls in exports. This finding indicates that the advantage conferred by GSP does not manifest itself in competitive improvements that make redundant their existence. We also find that the products included in the GSP increase its exports in other destinations, especially in the OECD; region similar to the United States market. This result suggests advantages associated with increased activity and experience in markets in advanced countries such as the United States. Finally, we note that the GSP promotes exports of goods favored at the expense of similar goods not included in the preferential access. This result reduces, at least partially, the effect pro-GSP exports and highlights potential trade diversion, even for the same exporting country, these programs can generate.

@article{albornoz2016exports, title = {Exports of Argentina and Brazil under the Generalized System of Preferences}, author = {Albornoz, Facundo and Brambilla, Irene and Garriga, Pablo}, journal = {Ensayos Económicos}, volume = {74}, number = {1}, pages = {27--55}, year = {2016}, doi = {https://doi.org/10.64285/ensayosbcra74.y2016.138}, group = {Publications}, }

Policy reports

- Latin America and the Caribbean Economic Review, April 2024 - Competition: The Missing Ingredient for Growth?William F. Maloney, Pablo Garriga, Marcela Meléndez, Raúl Morales, Charl Jooste, James Sampi, Jorge Thompson Araujo, and Ekaterina VostroknutovaApr 2024

Latin America and the Caribbean has made slow but consistent progress addressing the imbalances induced by the pandemic in an international environment that is just now showing signs of stabilizing. Despite favorable macroeconomic management, high interest rates and fiscal imbalances remain challenging while growth rates remain lackluster due to long-standing structural issues. This report focuses on weak competitive forces as a source of low productivity, low growth, and low welfare in LAC. It emphasizes the need for effective competition institutions, pro-competition regulatory frameworks, complementary policies to improve the capabilities of workers and firms, and enhanced innovation systems to prepare local industries to reach the technological frontier and face global competition.

@report{maloney2024competition, title = {Latin America and the Caribbean Economic Review, April 2024 - Competition: The Missing Ingredient for Growth?}, author = {Maloney, William F. and Garriga, Pablo and Meléndez, Marcela and Morales, Raúl and Jooste, Charl and Sampi, James and Araujo, Jorge Thompson and Vostroknutova, Ekaterina}, publisher = {World Bank}, address = {Washington, DC}, year = {2024}, month = apr, doi = {10.1596/978-1-4648-2111-0}, isbn = {978-1-4648-2111-0}, url = {https://hdl.handle.net/10986/41230}, group = {Policy reports}, } - Latin America and the Caribbean Economic Review, October 2024: Taxing Wealth for Equity and GrowthWilliam F. Maloney, Jorge Andres Zambrano, Guillermo Vuletin, Guillermo Beylis, and Pablo GarrigaOct 2024

The report highlights the progress made on inflation and, despite some resistance in the last mile, the resulting fall in interest rates that will ease pressures on debt service and investment. However, growth is projected to remain low, debt remains high, private and public investment is depressed, and the region appears to be missing the boat on nearshoring FDI. The need to generate more fiscal space, reduce the high corporate tax burden, and mitigate persistent inequality have moved wealth taxes to center stage. But traditional wealth taxes on financial assets face challenges due to the ease of moving and hiding assets which will be difficult to control without elusive global coordination. A viable alternative is a tax on real estate which is less mobile, easier to track, and less of a distortionary burden on economic activity, given the low initial rates. Property taxes also have the potential to reduce the excessive dependence of subnational governments on federal transfers. For property taxes to play a greater role, there must be improvements in property valuation which can be engineered through the use of digital platforms and centralized land registries.

@report{maloney2024taxing, title = {Latin America and the Caribbean Economic Review, October 2024: Taxing Wealth for Equity and Growth}, author = {Maloney, William F. and Zambrano, Jorge Andres and Vuletin, Guillermo and Beylis, Guillermo and Garriga, Pablo}, publisher = {World Bank}, address = {Washington, DC}, year = {2024}, month = oct, doi = {10.1596/978-1-4648-2182-0}, isbn = {978-1-4648-2182-0}, url = {https://hdl.handle.net/10986/42001}, group = {Policy reports}, } - Latin America and the Caribbean Economic Review, October 2025: Transformational Entrepreneurship for Jobs and GrowthWilliam F. Maloney, Guillermo Vuletin, Pablo Garriga, and Raul MoralesOct 2025

Latin America and the Caribbean faces a challenging outlook: slow economic and job growth, lower commodity prices, sluggish decline in global interest rates reducing demand and complicating debt service, weak investment, stalled nearshoring, and tight fiscal space. Structural gaps in infrastructure, education, regulation, competition, and tax policy curb technology adoption and quality job creation. The report highlights an entrepreneurship puzzle that despite high measured entrepreneurial spirit, status and activity in the region, growth remains low. This is due to a mass of informal micro firms with little intent to scale coexisting with a shallow pool of transformational firms. Education and STEM shortfalls shrink the pipeline; management quality, registered startups, and tecnolatinas lag peers. Two binding constraints—shallow financial markets and scarce skilled workers—impede scaling. Possible policy responses include strengthening human capital through improved education and targeted training, expanding access to finance by deepening capital markets and enhancing creditor protections, fostering competitive markets and innovation incentives, and modernizing labor regulations to reduce hiring costs.

@report{maloney2025transformational, title = {Latin America and the Caribbean Economic Review, October 2025: Transformational Entrepreneurship for Jobs and Growth}, author = {Maloney, William F. and Vuletin, Guillermo and Garriga, Pablo and Morales, Raul}, publisher = {World Bank}, address = {Washington, DC}, year = {2025}, month = oct, doi = {10.1596/978-1-4648-2298-8}, isbn = {978-1-4648-2298-8}, url = {https://openknowledge.worldbank.org/items/6323d1d1-0edf-4e01-b26c-47faa6aeb573}, group = {Policy reports}, }